Maharashtra Labour Welfare Fund (LWF) Amendment: A Landmark Reform in June 2024

Introduction:

In June 2024, Maharashtra witnessed a significant milestone in Labour welfare with the amendment of the Labour Welfare Fund (LWF) Act. This progressive move aims to bolster the welfare of the state's Labour force, ensuring that their socio-economic needs are met more comprehensively. This blog explores the specifics of the amendment, its implications, and its anticipated impact on both employers and employees across Maharashtra

The Labour Welfare Fund (LWF): An Overview

The Labour Welfare Fund (LWF) is a statutory contribution system designed to finance welfare activities for labourers. Managed by state governments, the fund is used for a range of welfare programs, including healthcare, education, housing, and recreational activities for workers and their families. Contributions are made by employers, employees, and the state government, creating a collaborative effort to enhance labour welfare.

Key Highlights of the June 2024 Amendment

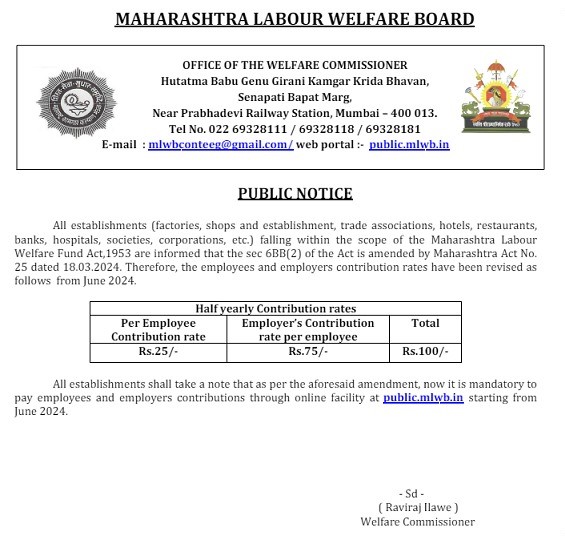

1. Revised Contribution Structure:

• The amendment introduces a revised contribution structure for both employers and employees. This adjustment is intended to align with the current economic conditions, ensuring a more robust fund for welfare activities.

• The new rates mark a significant increase from previous contributions, reflecting the growing needs and inflationary trends.

2. Broadened Coverage:

•The scope of the LWF Act has been expanded to cover a wider range of establishments and employees. This inclusion ensures that more workers benefit from the welfare schemes.

• Small-scale industries and certain informal sector workers, previously excluded, are now brought under the purview of the LWF.

3. Enhanced Welfare Benefits:

• With increased funds, the LWF can offer improved welfare benefits. This includes better healthcare services, educational scholarships, housing loans, and recreational facilities.

• The amendment aims to address the comprehensive needs of workers, ensuring their financial and social well-being.

4. Improved Administrative Efficiency:

• To ensure efficient fund utilization, the amendment includes provisions for enhanced administrative mechanisms. This involves greater transparency in fund allocation, regular audits, and stricter compliance measures for employers.

• The implementation of digital platforms for contributions and disbursements is also planned, making processes more streamlined and accessible.

Implications for Employers and Employees

For Employers:

• The increased contribution rates will require a higher financial outlay. However, this is balanced by the benefits of a healthier and more productive workforce.

• Employers will need to update their payroll systems to comply with the new regulations and ensure timely contributions to avoid penalties.

For Employees:

• The amendment promises improved welfare facilities, directly enhancing the quality of life for workers and their families.

• Workers can expect better healthcare services, more educational opportunities for their children, and enhanced recreational facilities.

Challenges and the Way Forward

The successful implementation of the amendment will require addressing several challenges:

• Ensuring compliance from all eligible establishments.

• Efficiently managing the increased funds and ensuring their proper utilization.

• Raising awareness among workers about the benefits available under the LWF.

Collaboration between the state government, employers, and Labour unions will be essential to address these challenges. Regular monitoring and feedback mechanisms will play a crucial role in ensuring the success of the amended LWF Act.

Conclusion

The June 2024 amendment to the Maharashtra Labour Welfare Fund Act represents a significant advancement in Labour welfare. By increasing contributions, expanding coverage, and enhancing benefits, the state is taking concrete steps towards improving the lives of its Labour force. While challenges remain, the collaborative efforts of all stakeholders can ensure that the benefits of this amendment reach the intended beneficiaries, fostering a more inclusive and supportive environment for workers in Maharashtra